Colorado Foreign LLC Registration

If you own an out-of-state LLC and want to expand your business reach into the Centennial State, you’ll need to register your company as a Colorado Foreign LLC (FLLC) by filing a Statement of Foreign Entity Authority with the CO SOS.

Here’s what you need to know:

- What is a Colorado Foreign LLC?

- Do I Need to Register My LLC in CO?

- How Our Foreign Registration Service Works

- How to Register Your Own FLLC

- Foreign LLC Registration FAQs

Hate paperwork? Well, we love it! Order Foreign Registration Service, and we’ll take care of your filing and provide you with a year of our affordable registered agent service. You’ll also get free use of our Colorado business address, access to additional services, and more perks!

CO Foreign LLC Registration

- $125 + state fees

What’s Included:

- Timely Statement of Foreign Entity Authority filing

- A year of Registered Agent Service

- Free use of our Colorado business address to increase your privacy

- Enrollment in Compliance Service to help protect your business

- Secure online account, accessible from anywhere

- Legal document scans and immediate uploads

- 3 free regular mail scans

- Free library of business documents & resources

- Lifetime customer service from local CO filing experts

- Access to additional filings (EIN, DBA) and services

What is a Colorado Foreign LLC?

A foreign LLC is any LLC formed outside the state of Colorado. (By contrast, any LLC formed in Colorado is called a domestic LLC.) When you register your out-of-state LLC to do business in Colorado, you’ve got a Colorado Foreign LLC.

Operating Across State Lines

In the US, it’s common to do business in multiple states, but creating a new LLC in each state where you do business isn’t practical.

The solution? Register your foreign LLC to do business in those other states (such as Colorado) using a process called foreign qualification.

Get Qualified to do Business in CO

To legally transact business with your foreign LLC in Colorado, you’ll need to register your LLC with the CO Secretary of State.

You’ll need to appoint a Colorado registered agent and file a State of Foreign Entity Authority form ($100).

Do I Need to Register My FLLC?

You’re required to register your foreign LLC if you’re transacting business in Colorado—but what exactly does “transacting business” mean?

Colorado state law addresses foreign registration requirements, but only by defining what does not constitute transacting business in Colorado. Luckily, an annotation to the law contains a positive definition of transacting business in the state.

Here’s what we can tell you (consult with an attorney for a firm answer):

- You need to register with state if you:

- Maintain an office in CO

- Have capital invested within the state

- Conduct regular business within the state

- You probably don’t need to register if you only:

- Hold meetings in CO

- Own property in CO

- Have bank accounts in CO

- Sell through independent contractors in CO

- Going to court in CO (for example, maintaining, defending, or settling a lawsuit)

For a complete list of activities that aren’t considered transacting business, refer to state statute CRS 7-90-801.

How Our CO FLLC Registration Service Works

Expand your business reach into Colorado! We’ll serve as your local registered agent and take care of your registration paperwork.

1

Sign up for Foreign Registration Service

You provide us with basic information about your company, and we do the rest—you can even use our Colorado business address if you need to!

We give you instant Colorado Registered Agent service and then file your Statement of Foreign Entity Authority.

Foreign Registration Service costs $125 + state fees.

2

Start doing business in CO

As soon as the SOS accepts your Statement of Foreign Entity Authority, we upload your confirmation to your online account and send you a notification email.

Then you can start operating in Colorado.

3

We keep you in compliance

We include enrollment in Compliance Service with Foreign Registration Service so that you never miss a Periodic Report filing (equivalent to an Annual Report in other states).

We send you a reminder before your Periodic Report is due. Then we file on your behalf ($100 + the state fee, charged only at filing) so that your FLLC isn’t put at risk of non-compliance for failing to file.

If you’d rather file yourself, just cancel the service in your online account.

4

Re-up your RA Service

We serve as your CO registered agent for a full year.

We’ll remind you when the year’s almost up. You can continue your Registered Agent Service for $25 the next year (and every year after that).

How to Register Your Own FLLC

Prefer to file on your own? Here’s how to register a foreign LLC in Colorado.

1. Obtain a Colorado Registered Agent

All Colorado foreign LLCs must have a registered agent that is located within the state of Colorado so that the CO Secretary of State can easily get important legal documents to your company when necessary.

Because you must list your CO registered agent on your Statement of Foreign Entity Authority, you need to appoint your agent before submitting your application. If you don’t list a Colorado registered agent on your Statement, your filing will be rejected.

Who should I designate as my CO registered agent?

You can designate one of your employees who resides in Colorado or another Colorado business connection, such as a lawyer, as your Colorado registered agent.

However, for most companies, the most convenient and reliable solution is to hire a registered agent service based in Colorado.

2. Confirm That Your LLC Name is Available

In Colorado, all registered business entity names must be unique. So, if another company—this includes both companies formed in CO and foreign companies with the authority to operate in CO—is registered under your company’s legal business name, you won’t be able to use that business name in Colorado.

To find out if your name is available, you can use the Colorado Name Availability Search.

FYI: The state of Colorado refers to a company’s legal business name as its “true name.”

What if my company name isn’t available?

You’ll have to choose an assumed name to use in Colorado if your true name isn’t available.

Luckily, you won’t have to file any additional paperwork. Here’s what you’ll need to do:

If your name isn’t available:

On your Statement of Authority, you’ll simply list your assumed name under “Entity Name” and your legal business name under “True Name.”

If your name is available:

To use your legal business name in CO, all you need to do is put your legal business name down under “Entity Name.” (If you want to use a different name anyway, you can file a Statement of Trade Name of Reporting Entity to get a CO Trade Name.)

How do I prevent other businesses from using my name?

To keep other businesses in Colorado from using your legal business name, you can file a Statement of Registration of True Name ($25) along with your Statement of Foreign Entity Authority.

Filing a Statement of Registration of True Name isn’t required, but it does prevent other business entities from using your business name in CO. This helps ensure that you keep control over your name and protects your brand.

3. File a Statement of Foreign Entity Authority

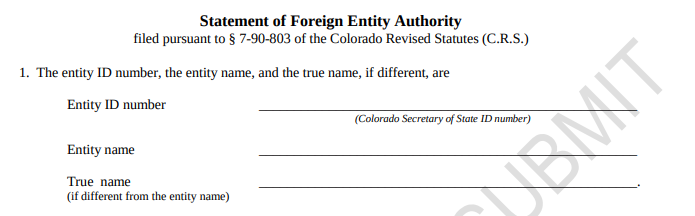

Next, you’ll file your Statement of Foreign Entity Authority with the Colorado Secretary of State. Although the state provides a sample form for this filing, you must complete your application online.

1. When you access the Statement of Foreign Entity Authority from the Colorado Business Forms List, you’ll first be directed to a True Name Availability Search to verify that your business name is available.

2. After completing the search, you’ll be taken to the online Statement of Foreign Entity Authority Form.

3. On your form, you’ll need to provide:

- Your Entity Name (the name you’ll operate under in CO)

- True Name (if different from your Entity Name)

- The form (type) of entity you’re registering the jurisdiction where it was formed

- Your principal office address (must be a street address) and mailing address

- The date you’ll start doing business in CO

- Your CO registered agent’s name, address, and consent

- The name and address of the person causing the document to be filed

4. You’ll pay the filing fee: $100. If you also choose to file a Statement of Registration of True Name, that comes with an additional $25 filing fee.

Once your Statement is accepted, you’re ready to start making money in Colorado.

4. Submit Your Periodic Report Each Year

The Periodic Report is a yearly filing that all registered Colorado business entities, including foreign LLCs, are required to file every year. This report keeps your FLLC information current with the state. You can update changes to your business address and/or your registered agent name and address when you file.

To find out when your Periodic Report is due, look up your FLLC record using the SOS’s Business Database Search. The fee to file your report is $25.

Find out how to form a domestic Colorado LLC instead.

Colorado Foreign LLC FAQs

Have questions? We’ve got answers.

How much does it cost to register a FLLC in Colorado?

Filing a Statement of Foreign Entity Authority with the CO SOS costs $100. If you also choose to file a Statement of Registration of True Name, that form has a filing fee of $25.

Do I need to file a Periodic Report?

All business entities in Colorado, including Colorado foreign LLCs, must file a Periodic Report each year. This report helps keep your information up-to-date with the state.

If you fail to file your Periodic Report, your LLC will be marked as Delinquent. After 400 days of delinquency, your business name will be made available, and you may lose your name to another business. Plus, to restore your LLC from delinquency, you’ll need to file a Statement Curing Delinquency, which costs $100.

How does Compliance Service work?

To protect your FLLC from falling into delinquency, we include enrollment in Compliance Service with our FLLC Registration Service.

We notify you when your report deadline is approaching and then file your report on your behalf, well ahead of the due date ($100 plus the state fee, charged only at filing). This will keep you in compliance without you having to do anything.

To file on your own, just cancel the service in your account.

Do I need to pay taxes in Colorado?

For information on paying taxes in Colorado, it’s best to consult a tax professional. If you have a physical location in Colorado, you may need to report your FLLC’s income to the state and pay personal income tax in Colorado.

Regardless of whether or not you have a physical location in the state, if your annual sales in Colorado exceed $100,000, your company will need to collect and pay Colorado Sales Tax. For more information, refer to the Colorado Department of Revenue’s Information for Out-of-State Businesses.